Executive Bonus Plan

RESOURCES

Definition of Welfare Benefit Plan

ERISA § 3(1); 29 U.S.C. § 1002(1)

The terms “employee welfare benefit plan” and “welfare plan” mean any plan, fund, or program which was heretofore or is hereafter established or maintained by an employer or by an employee organization, or by both, to the extent that such plan, fund, or program was established or is maintained for the purpose of providing for its participants or their beneficiaries, through the purchase of insurance or otherwise, (A) medical, surgical, or hospital care or benefits, or benefits in the event of sickness, accident, disability, death or unemployment, or vacation benefits, apprenticeship or other training programs, or day care centers, scholarship funds, or prepaid legal services, or (B) any benefit described in section 186(c) of this title (other than pensions on retirement or death, and insurance to provide such pensions).

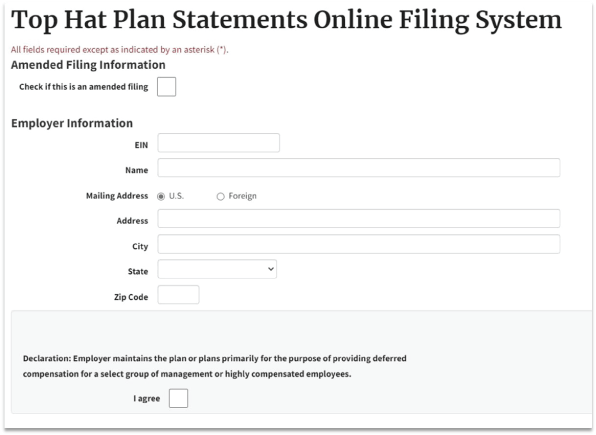

U.S. Department of Labor Top Hat Statement

Top hat plans are unfunded or insured pension plans for a select group of management or highly compensated employees. Plan administrators of “top hat” plans must use this web page to electronically file the statement described in section 2520.104-23 of the Department of Labor’s regulations. The Department published a final regulation that makes it mandatory to electronically file the statement. To go directly to the statement, click here: Top Hat Plan Statements Online Filing System. For your information, a portion of the statement is shown to the right:

Instructions

- Fill in the information requested. All fields are required unless otherwise indicated. Note that you must accept the declaration by checking the box next to “I accept” to proceed with your filing. For non-U.S. addresses, click on Foreign and complete all of the relevant fields including province or state, country, and postal Code.

- In the Plan Information section, enter the number of plans for which you are filing statements and click submit. You will then see the appropriate number of boxes for you to enter each plan’s information.

- Attachments cannot be included with your filing. If you wish to add information, use the Additional Information box. For example, you may use the Additional Information box if you want to report on controlled group information. See Advisory Opinion 2008-08A.

- Note that incomplete statements cannot be saved and completed later.

- Once you have entered your information, review your filing by clicking the “Review” button at the bottom of the page. You may either return to the statement to make necessary corrections or submit the filing. Remember that once you submit your statement, you cannot access the statement to make changes.

- Click the “Submit” button to complete your filing. After you submit your statement, you will receive a confirmation number and a downloadable PDF of your filing. Save or print the PDF for your records by clicking on the “Download filing PDF Format.” The plan administrator will receive a confirmation email with this information. Please retain this information for your records.

- An existing top hat filing by an employer does not cover a new top hat plan that is subsequently adopted. A new filing, however, is not required when a top hat plan is amended to include a separate class of participants. Whether a new arrangement is a separate plan or rather is part of an existing plan is determined under all the facts and circumstances.

- If you make a mistake when you submit a filing, you need to file an amended statement. Because the amended filing will be substituted for the filing with a mistake, you must check the amended filing box at the top of the first screen and enter the confirmation number of the original filing in the field Prior Confirmation Number.

Resource Library

Additional Training

1 The use of cash value life insurance to provide a tax-free resource for accumulation goals assumes that there is first a need for the death benefit protection. The ability of a life insurance contract to accumulate sufficient cash value to help meet accumulation goals will be dependent upon the amount of extra premium paid into the policy, and the performance of the policy , and is not guaranteed. Policy loans and withdrawals reduce the policy’s cash value and death benefit and may result in a taxable event. Withdrawals up to the basis paid into the contract and loans thereafter will not create an immediate taxable event, but substantial tax ramifications could result upon contract lapse or surrender. Surrender charges may reduce the policy’s cash value in early years.

2 Life insurance generally provides a tax-free death benefit (Per Internal Revenue Code § 101(a)(1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning your individual situation.

National Life Group® is a trade name of National Life Insurance Company, Montpelier, VT, Life Insurance Company of the Southwest, Addison, TX and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. Life Insurance Company of the Southwest is not an authorized insurer in New York and does not conduct insurance business in New York.

Brochures and flyers linked to in this communication are approved for print use only. Please note that email marketing is subject to additional anti-spam requirements and should be submitted for advertising compliance approval prior to use. Seminars should be submitted for review of your personalization along with any invitations, announcements or other collateral marketing materials.

The companies of National Life Group® and their representatives do not offer tax or legal advice. Please encourage your clients to seek tax or legal advice from their appropriate professional advisor.

No bank or credit union guarantee | Not a deposit | Not FDIC/NCUA insured | May lose value | Not insured by any federal or state government agency

Guarantees are dependent upon the claims-paying ability of the issuing company.

FOR AGENT USE ONLY - NOT FOR USE WITH THE PUBLIC

TC141219(0424)3 | Cat 106284(0424)