Executive Bonus Plan

IMPLEMENTATION

Although implementing an executive bonus plan is relatively straightforward, there are several steps to take and requirements to satisfy to ensure a successful implementation. The following represents those steps and requirements, as well as the person(s) with primary accountability for executing each step. Note that it is important that agents remain involved throughout the entire process to assist and consult as appropriate.

Agent

Agent

Identify current or prospective business owner clients who value their best employees and who desire to reward and retain them with a nonqualified executive benefit.

Agent/Employer & Legal Advisors

Agent/Employer & Legal Advisors

Determine if a § 162 executive bonus plan meets the objectives of the business owner.

Employer & Legal Advisors

Employer & Legal Advisors

Establish the rules for an employee to receive a bonus.

Employer

Employer

Determine the budget that will be allocated towards the plan and each participant.

Agent

Agent

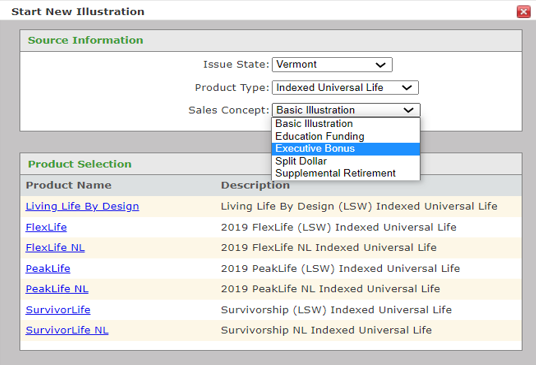

Determine the type of bonus and run a proposal using the executive benefit illustration template. (Visit Running Illustrations for an image of the template.)

Agent/Employee

Agent/Employee

Apply for the life insurance policy and get an underwriting approval.

Legal Advisors

Legal Advisors

Revise or draft an agreement stating the terms and requirements for the bonus.

Employer

Employer

Formally adopt the bonus plan in a corporate board resolution and document in the corporate minutes.

Employer

Employer

Submit the Top Hat Plan Statement on the Department of Labor website or visit Resources for more information.

Employer

Employer

Notify and coordinate premium payments with the payroll department or the corporate accountant.

Agent

Agent

If applicable, file the Restrictive Ownership Provision Request Form (Form #6502).

Agent

Agent

Upon policy issue, deliver the policy to the employee participant.

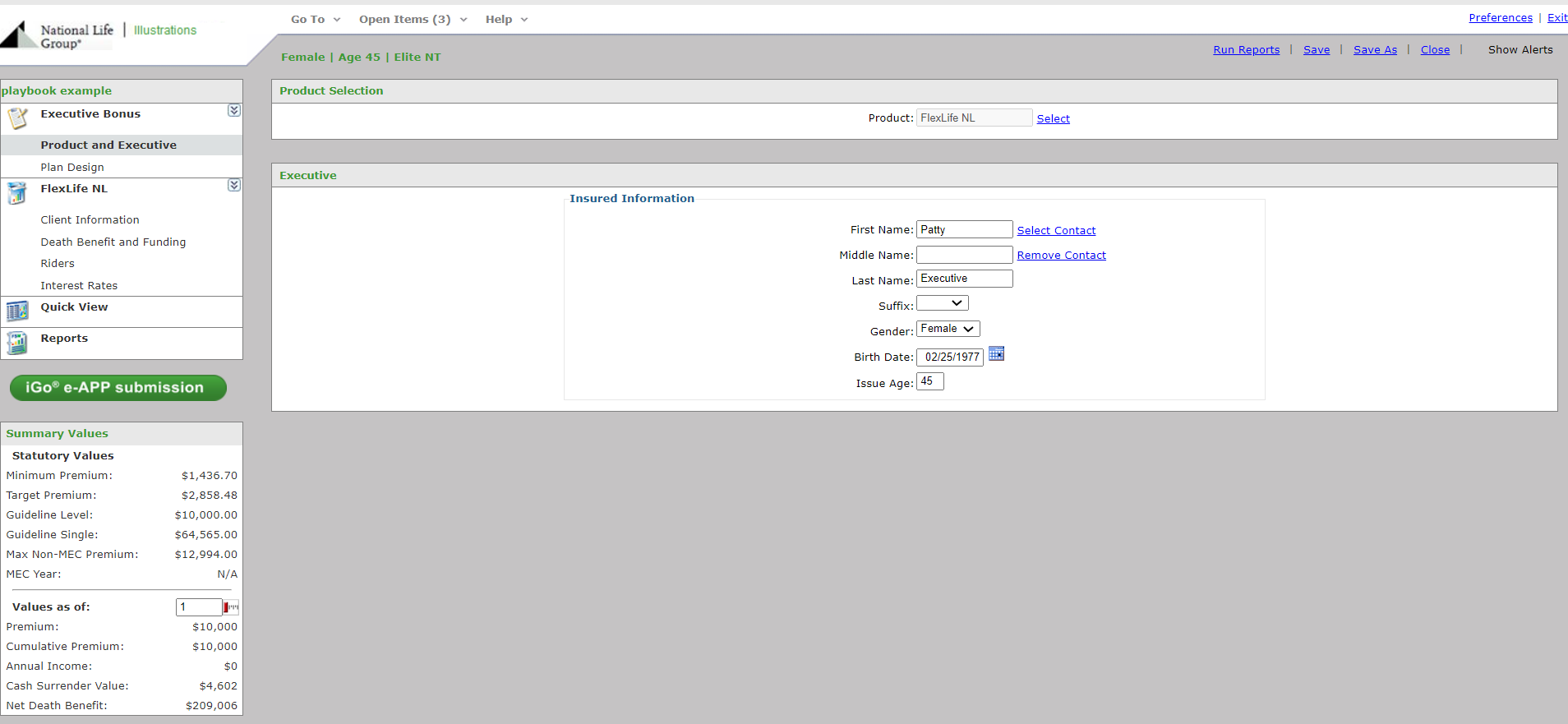

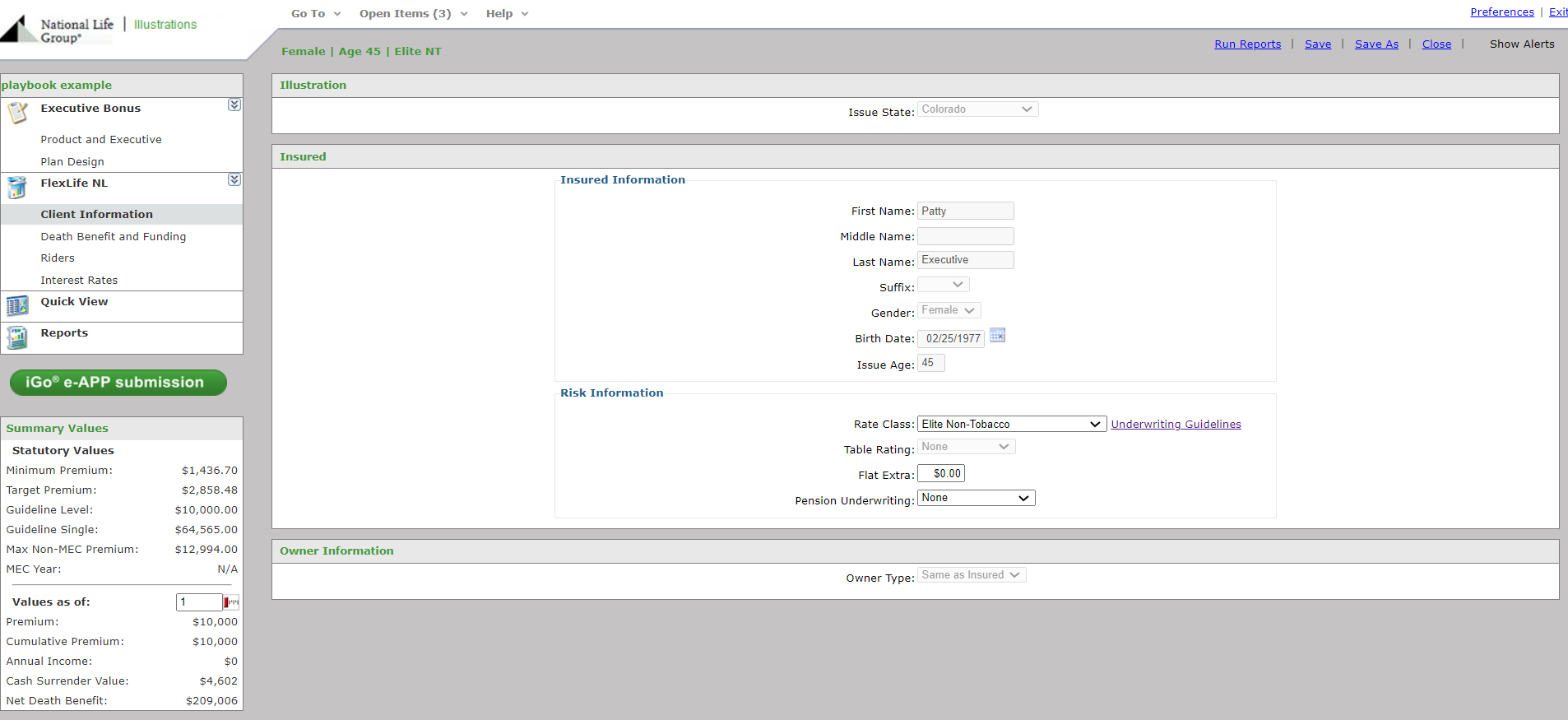

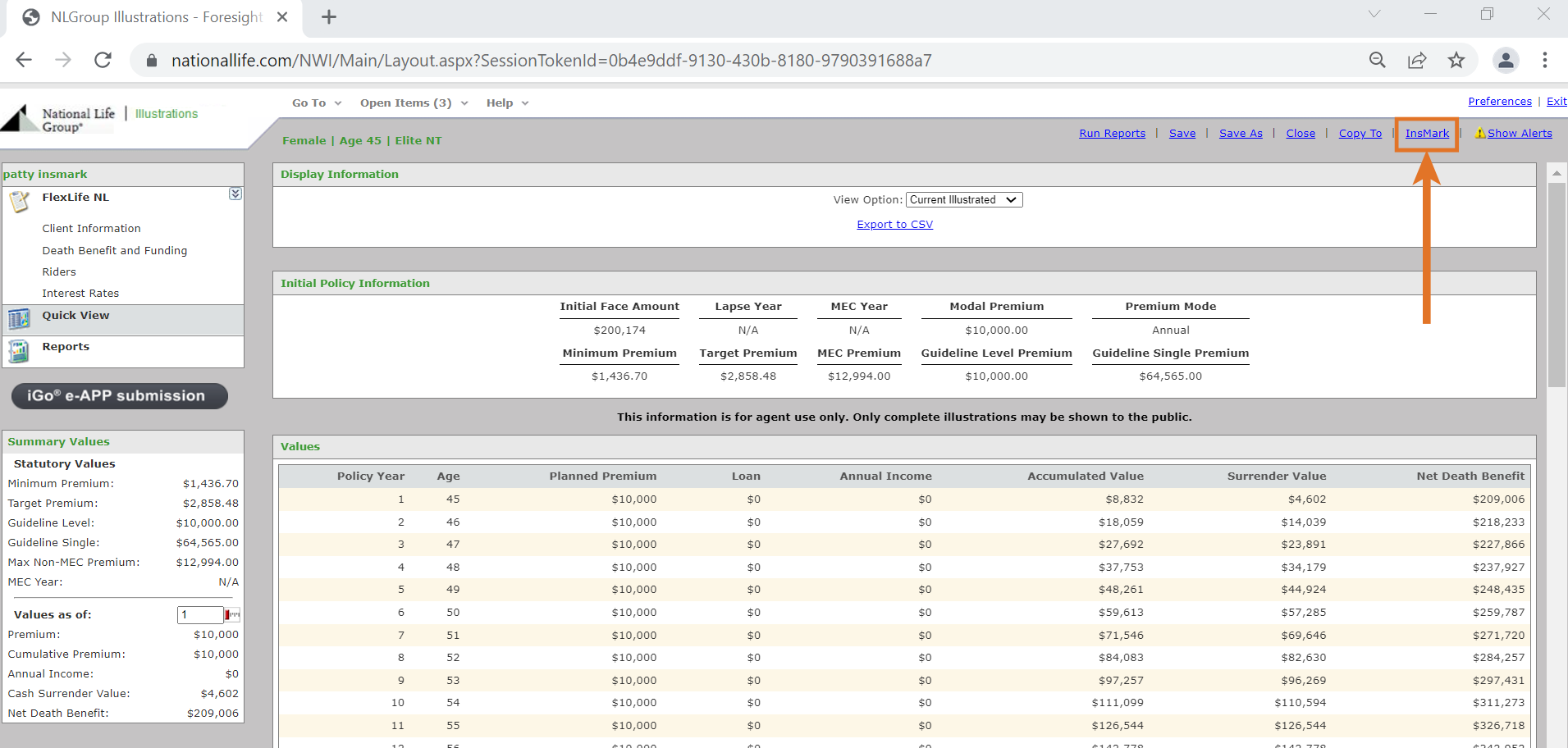

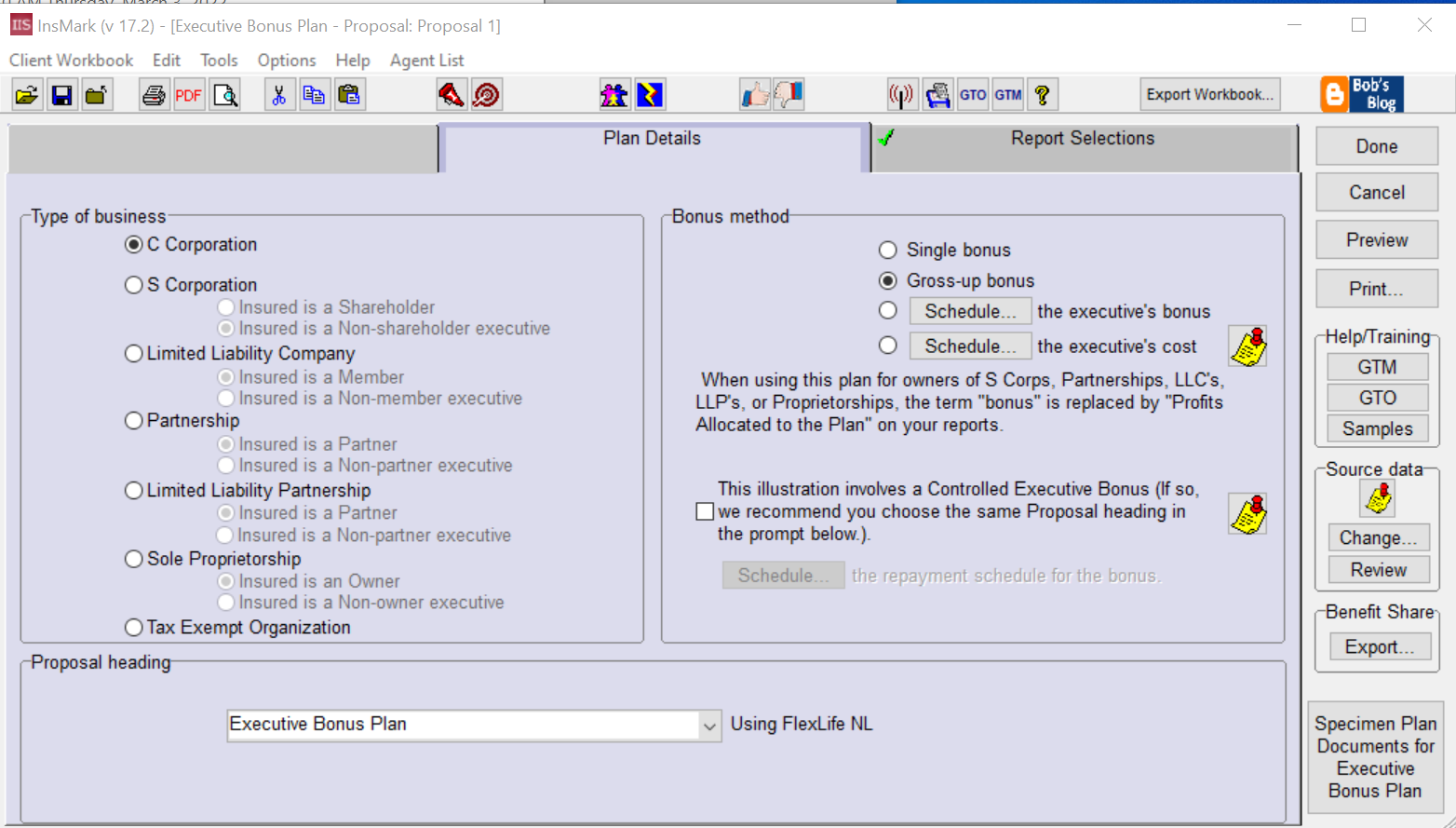

RUNNING ILLUSTRATIONS

There are two ways you can illustrate an executive bonus plan: through NLGroup Illustration System or through InsMark. Following are instructions on how to access the appropriate sections of these applications, screenshots, and sample illustration proposals for our Case Study.

NLGroup Illustration System

Click screenshots to view larger image.

Next, complete the information in the remaining tabs and then preview the proposal or run the full illustration for review.

InsMark Illustration System

Click screenshots to view larger image.

Finally, you select the reports you want to view and select the preview button to see the proposal

Resource Library

Additional Training

1 The use of cash value life insurance to provide a tax-free resource for accumulation goals assumes that there is first a need for the death benefit protection. The ability of a life insurance contract to accumulate sufficient cash value to help meet accumulation goals will be dependent upon the amount of extra premium paid into the policy, and the performance of the policy , and is not guaranteed. Policy loans and withdrawals reduce the policy’s cash value and death benefit and may result in a taxable event. Withdrawals up to the basis paid into the contract and loans thereafter will not create an immediate taxable event, but substantial tax ramifications could result upon contract lapse or surrender. Surrender charges may reduce the policy’s cash value in early years.

2 Life insurance generally provides a tax-free death benefit (Per Internal Revenue Code § 101(a)(1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning your individual situation.

National Life Group® is a trade name of National Life Insurance Company, Montpelier, VT, Life Insurance Company of the Southwest, Addison, TX and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. Life Insurance Company of the Southwest is not an authorized insurer in New York and does not conduct insurance business in New York.

Brochures and flyers linked to in this communication are approved for print use only. Please note that email marketing is subject to additional anti-spam requirements and should be submitted for advertising compliance approval prior to use. Seminars should be submitted for review of your personalization along with any invitations, announcements or other collateral marketing materials.

The companies of National Life Group® and their representatives do not offer tax or legal advice. Please encourage your clients to seek tax or legal advice from their appropriate professional advisor.

No bank or credit union guarantee | Not a deposit | Not FDIC/NCUA insured | May lose value | Not insured by any federal or state government agency

Guarantees are dependent upon the claims-paying ability of the issuing company.

FOR AGENT USE ONLY – NOT FOR USE WITH THE PUBLIC

TC141219(0424)3 | Cat 106284(0424)