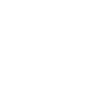

Effective client engagement centers around helping employees visualize and plan for a secure retirement. Most will receive only a fraction of their income from a pension. Social Security may offer a small supplement (or none at all for certain public employees).

Your message is powerful:

You may need to replace 80–90% of your income in retirement. Your pension alone won’t get you there — but contributing to your employer’s retirement plan can help.

Prepare to Talk Pensions

Study your client’s home state pension plan. When you know its basics, you can speak to its shortfalls. Access every state’s retirement system website at nationallife.com/Individuals-Families-Retirement-Plans

Engage Employees

Prospecting and relationship-building opportunities are extensive and include a combination of on-site, off-site and virtual openings. Get acquainted with the following four tools and consider how you will leverage them across these opportunities.

Engagement Tips and Guidelines

This guide presents proven strategies for connecting with school district employees, decision-makers, and influencers. Whether you’re educating, building relationships, or generating leads, these techniques are designed to help you establish trust and deliver value.

1. Educational Events & Workshops

- Host informative sessions to help school employees understand their retirement plan options, like 403(b)s

- Schedule breakfast briefings, lunch-and-learns, or evening workshops

- Use venues like libraries, restaurants, museums, or school-provided spaces (where allowed)

- Encourage clients to bring colleagues; peer-to-peer referrals are powerful

- Utilize our marketing and presentation tools to promote and deliver polished, engaging content

2. Meetings with Staff, Faculty, and Leadership

- Coordinate with school administrators to attend staff, faculty, and union meetings

- Join all-employee or in-service meetings, especially around the start of the school year

- Introduce yourself and your purpose in a concise, relatable way — focus on their financial challenges and how you can help

- Participate in superintendent and leadership luncheons to stay informed and position yourself as a partner

3. Appreciation & Networking Events

- Organize client appreciation nights to deepen relationships and encourage referrals

- Invite clients and ask them to bring a guest from the district

- Choose a relaxed venue with light refreshments and consider adding a short, value-driven talk or guest speaker

- Include testimonials from existing clients to build credibility and connection**

4. Presence at Benefit & HR Events

- Participate in benefit fairs and HR-led initiatives when possible

- These events attract engaged employees looking for guidance on healthcare, insurance, and retirement

- Use attention-grabbing, compliant materials to make your booth or table stand out

5. Targeted Campaigns & Outreach

- Send tailored e-mails or printed mailers with relevant themes such as retirement readiness or financial wellness

- Follow district rules regarding email blasts; use compliance-approved templates when needed

- Encourage clients to forward your messages or refer peers

- Build prospect lists using publicly available educator contact info by region or county

6. Advertising & Visibility Tactics

- Advertise in school publications or union newsletters to get in front of your audience consistently

- These ads are often well-received and help boost name recognition in the community

7. One-on-One Appointments

- Offer flexible meeting options based on the comfort and preferences of the client

- Whether at school, at home, or in a neutral location like a café or office, be respectful of their time and privacy

- Offsite meetings often allow for deeper conversations and greater involvement from spouses or partners

8. Community & Legislative Engagement

- Share your involvement in local community service — educators value partners who give back

- Reach out to local state legislators to inform them of your work with their constituents

- These relationships can support your efforts by opening doors and affirming your role as a community contributor

Best Practices for Success

Always follow district-specific policies for access, communications, and event participation

Display identification and maintain a professional presence during all interactions

Lead with education, empathy, and a service-first approach — build trust before business

Leverage stories, testimonials, and real-life impact to create connections

Additional Tools & Resources are available on the Agent Portal.

To go there directly:

Don’t know who to contact?

Send an email to the team at RetirementServices1@NationalLife.com

or call 866-243-7174

Source: IRS 2025

* This hypothetical example is used for illustrative purposes only. Actual results will vary.

** Please ensure you follow state and National Life Group rules regarding client testimonials and how/where they may be used.

- The index strategies of fixed indexed annuities credit interest based in part on the change in a market index such as this one. Indexed annuities do not directly participate in any stock or equity investments. When discussing this or other index strategies with your client, explain that this is not an investment in the market and that this is a method for crediting interest and disclose any cap, participation rate or threshold that will apply. For an Index with volatility control and the additional costs deducted from the Index value, the positive Index value change may be less than that of similar indices that do not include volatility control and do not deduct these costs. When included in a fixed indexed annuity with the protection of a 0% or 1% floor, the benefit of reduced downside will not be realized for index returns below 0% or 1%. Indexed annuities do not directly participate in any stock or equity investments. This is not a solicitation of any specific annuity contract. Guarantees are dependent upon the claims-paying ability of the issuing company. Assuming no withdrawals made during the surrender charge period and no rider charges.

- Guaranteed Lifetime Income Riders (GLIRs) are only available to purchase on Life Insurance Company of the Southwest (LSW) fixed indexed annuities. Riders are an optional benefit for which premium is charged, are available at issue only, and may not be available in all states.

Registered Representatives and Investment Adviser Representatives of, and securities and investment advisory services are offered solely by Equity Services, Inc., Member FINRA/SIPC. Equity Services, Inc. is a Broker/Dealer and Registered Investment Adviser affiliate of National Life Insurance Company (NLIC). National Life Group® (NLG) is a trade name of NLIC, Montpelier VT, Life Insurance Company of the Southwest (LSW), Addison TX and its affiliates. Each company is solely responsible for its own financial condition and contractual obligations. LSW is not an authorized insurer in NY and does not conduct insurance business in NY. In CO, MO, NH and WI, Equity Services, Inc. operates as Vermont Equity Services, Inc

The companies of National Life Group® and their representatives do not offer tax or legal advice. Please encourage your clients to seek tax or legal advice from their appropriate professional advisor.

FOR AGENT USE ONLY – NOT FOR USE WITH THE PUBLIC

TC8049010(0625)3 | Cat No 108134(0625)