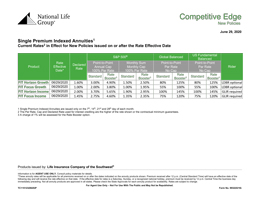

Single Premium Indexed Annuities

Not available to sell in NY

Four products that can help your clients grow and protect their retirement savings

PROTECT your principal.

GROW your assets securely.

MAXIMIZE your growth potential.

Your customers can leverage a selection of product features:

Rate Boosters

The optional Rate Booster strategies provide greater interest crediting potential1 and are available on all indexed crediting options. Policyholders may:

- Allocate between the boosted and non-boosted strategies.

- Reallocate annually into or out of boosted strategies.

Only funds allocated to Rate Booster strategies pay a 1% annual charge deducted from its Accumulation Value and rates are subject to change.

Riders included at no additional cost (subject to state availability)

The following riders are available at no additional cost in states where approved.

Nursing Care – Gives clients peace of mind that they will have access to a portion of savings without surrender charges in the case of a qualifying event.

Not available in: CA, IL, LA, MA, MT, NH, NJ, SC, SD, WA, WV, WI. See policy for qualification and limitations.

Terminal Illness Benefit – Eliminates withdrawal charges for the annuitant on one withdrawal if the policy has been in force longer than one year at the onset of the terminal illness, from which the client is physician-certified to have 12 months or fewer to live.

Not available in: CA, IL, LA, MA, MO, MT, NH, NJ, OR, PA, SC, UT, WV, WI. See policy for qualification and limitations.

Emergency Access Waiver — Allows clients to have all withdrawal charges waived for 403(b) hardship or 457(b) unforeseen emergency distributions, if approved by the Plan/TPA. For separation from service or disability, 20% of withdrawal charges (for withdrawals above 10% of the accumulation

value) are waived in years 2-4; starting in year 5, all withdrawal charges are waived.

Available for 403(b) and 457(b) plans only. Approved in all states. See policy for qualification and limitations.

Zenith Growth 5

Zenith Growth 7

Zenith Growth 10

1. Rate Booster only benefits interest crediting during periods where interest is credited to that strategy. If no indexed interest is credited for that period, Rate Booster will have no effect. The charge for Rate Booster occurs for every crediting period regardless of whether interest is credited.

For Agent Use Only – Not For Use With The Public

TC7810225(0425)3

Protected From Market Risk.

Ready to Grow.

Immediate Premium Bonus.

Your customers can leverage a selection of product features:

Rate Boosters

The optional Rate Booster strategies provide greater interest crediting potential1 and are available on all indexed crediting options. Policyholders may:

- Allocate between the boosted and non-boosted strategies.

- Reallocate annually into or out of boosted strategies.

Only funds allocated to Rate Booster strategies pay a 1% annual charge deducted from its Accumulation Value and rates are subject to change.

Riders included at no additional cost (subject to state availability)

The following riders are available at no additional cost in states where approved.

Nursing Care – Gives clients peace of mind that they will have access to a portion of savings without surrender charges in the case of a qualifying event.

Not available in: CA, IL, LA, MA, MT, NH, NJ, SC, SD, WA, WV, WI. See policy for qualification and limitations.

Terminal Illness Benefit – Eliminates withdrawal charges for the annuitant on one withdrawal if the policy has been in force longer than one year at the onset of the terminal illness, from which the client is physician-certified to have 12 months or fewer to live.

Not available in: CA, IL, LA, MA, MO, MT, NH, NJ, OR, PA, SC, UT, WV, WI. See policy for qualification and limitations.

Emergency Access Waiver — Allows clients to have all withdrawal charges waived for 403(b) hardship or 457(b) unforeseen emergency distributions, if approved by the Plan/TPA. For separation from service or disability, 20% of withdrawal charges (for withdrawals above 10% of the accumulation

value) are waived in years 2-4; starting in year 5, all withdrawal charges are waived.

Available for 403(b) and 457(b) plans only. Approved in all states. See policy for qualification and limitations.

Growth Driver 7

Growth Driver 10

1. Rate Booster only benefits interest crediting during periods where interest is credited to that strategy. If no indexed interest is credited for that period, Rate Booster will have no effect. The charge for Rate Booster occurs for every crediting period regardless of whether interest is credited.

For Agent Use Only – Not For Use With The Public

TC7810225(0425)3

Protected From Market Risk.

Ready to Grow.

Predictable Guaranteed Lifetime Income.

Your customers can leverage a selection of product features:

Rate Boosters

The optional Rate Booster strategies provide greater interest crediting potential1 and are available on all indexed crediting options. Policyholders may:

- Allocate between the boosted and non-boosted strategies.

- Reallocate annually into or out of boosted strategies.

Only funds allocated to Rate Booster strategies pay a 1% annual charge deducted from its Accumulation Value and rates are subject to change.

Guaranteed Lifetime Income Rider (GLIR)

The GLIR rider ensures that customers have the option to receive predictable retirement income that they can never outlive, while leaving them in control of their remaining Accumulation Value.

Income Driver clients must select either Standard GLIR or No-Charge GLIR at issue. The annual cost for the Standard GLIR is 1% of the Benefit Calculation Base deducted from the Account Value.

Standard GLIR

GLIR is designed to kickstart retirement income with a 25% upfront bonus to the Benefit Calculation Base (BCB), which determines how much future lifetime income can be paid.

How it works

- The BCB equals premium paid at issue and is increased by a 25% bonus.

- The BCB rolls up at an 10% simple roll-up rate until the earlier of election of income or the 10th policy anniversary.

- At election of income, the BCB is multiplied by a Guaranteed Withdrawal Percentage based on the annuitant’s attained age to determine lifetime income.

This GLIR has a 1% annual charge based on the BCB deducted from the accumulation value

No Charge GLIR

How it works

- The Benefit Calculation Base (BCB), equals premium paid.

- The BCB rolls up at an 10% simple roll-up rate until the earlier of election of income or the 10th policy anniversary.

- At election of income, the BCB is multiplied by a Guaranteed Withdrawal Percentage based on the annuitant’s attained age to determine lifetime income.

GLIR Income Doubler

The GLIR Income Doubler doubles lifetime income for up to 5 years when it is needed most.

To qualify for the Income Doubler, the annuitant must be unable to perform two of the six Activities of Daily Living permanently,

Activities of Daily Living

- Bathing

- Toileting

- Transferring

- Dressing

- Continence

- Eating

AND

- Policy must be in force for at least 2 years.

- Policy Accumulation Value is greater than zero.

- Income is elected on single life.

- No Excess Withdrawals taken in current policy year.

- Annuitant resides in United States.

When these requirements are met, annuitant income is doubled until the earlier of 5 years since Doubler activation, or the depletion of Accumulation Value.

GLIR Increasing Income Option

Choice of Level or Increasing Income at activation allows for annual income increases as a hedge against inflation.

Level

Income is received at a level rate for life.

Increasing

The initial income is less than level income, due to the Guaranteed Withdrawal Percentage being 1% lower at all ages.

- Income increases by 2.5% compounding until the Accumulation Value is depleted.

- After depletion income remains at highest level thereafter.*

*Assuming no excess withdrawals.

Riders included at no additional cost (subject to state availability)

The following riders are available at no additional cost in states where approved.

Nursing Care – Gives clients peace of mind that they will have access to a portion of savings without surrender charges in the case of a qualifying event.

Not available in: CA, IL, LA, MA, MT, NH, NJ, SC, SD, WA, WV, WI. See policy for qualification and limitations.

Terminal Illness Benefit – Eliminates withdrawal charges for the annuitant on one withdrawal if the policy has been in force longer than one year at the onset of the terminal illness, from which the client is physician-certified to have 12 months or fewer to live.

Not available in: CA, IL, LA, MA, MO, MT, NH, NJ, OR, PA, SC, UT, WV, WI. See policy for qualification and limitations.

Emergency Access Waiver — Allows clients to have all withdrawal charges waived for 403(b) hardship or 457(b) unforeseen emergency distributions, if approved by the Plan/TPA. For separation from service or disability, 20% of withdrawal charges (for withdrawals above 10% of the accumulation value) are waived in years 2-4; starting in year 5, all withdrawal charges are waived.

Available for 403(b) and 457(b) plans only. Approved in all states. See policy for qualification and limitations.

Income Driver 7

Income Driver 10

1. Rate Booster only benefits interest crediting during periods where interest is credited to that strategy. If no indexed interest is credited for that period, Rate Booster will have no effect. The charge for Rate Booster occurs for every crediting period regardless of whether interest is credited.

For Agent Use Only – Not For Use With The Public

TC7810225(0425)3

Protected From Market Risk.

Ready to Grow.

Maximized lifetime income.

Your customers can leverage a selection of product features:

Rate Boosters

The optional Rate Booster strategies provide greater interest crediting potential1 and are available on all indexed crediting options. Policyholders may:

- Allocate between the boosted and non-boosted strategies.

- Reallocate annually into or out of boosted strategies.

Only funds allocated to Rate Booster strategies pay a 1% annual charge deducted from its Accumulation Value and rates are subject to change.

Guaranteed Lifetime Income Rider (GLIR)

The GLIR rider ensures that customers have the option to receive retirement income that they can never outlive, while leaving them in control of their remaining Accumulation Value.

Zenith Income clients must select either the Max Bonus GLIR or the Split Bonus GLIR at issue. The annual cost is 1% of the Accumulation Value.

Max Bonus GLIR

The Max Bonus GLIR provides a one-time activation bonus that boosts your payments when you are ready to start receiving income. The activation bonus increases the amount of income you receive by 115%-200%, depending on when you activate the GLIR. This GLIR has a 1% annual charge.

Split Bonus GLIR

The Split Bonus GLIR provides a 5% premium bonus, increasing the accumulation value at issue. It also gives you a one-time activation bonus that boosts your payments when you are ready to start receiving income. This GLIR has a 1% annual charge.

GLIR Income Doubler (not available in CA)

The GLIR Income Doubler doubles lifetime income for up to 5 years when it is needed most.

To qualify for the Income Doubler, the annuitant must be unable to perform two of the six Activities of Daily Living permanently,

Activities of Daily Living

- Bathing

- Toileting

- Transferring

- Dressing

- Continence

- Eating

AND

- Policy must be in force for at least 2 years.

- Policy Accumulation Value is greater than zero.

- Income is elected on single life.

- No Excess Withdrawals taken in current policy year.

- Annuitant resides in United States.

When these requirements are met, annuitant income is doubled until the earlier of 5 years since Doubler activation, or the depletion of Accumulation Value.

GLIR Increasing Income Option

Choice of Level or Increasing Income at activation allows for annual income increases as a hedge against inflation.

Level

Income is received at a level rate for life.

Increasing

The initial income is less than level income, due to the Guaranteed Withdrawal Percentage being 1% lower at all ages.

- Income increases by 2.5% compounding until the Accumulation Value is depleted.

- After depletion income remains at highest level thereafter.*

*Assuming no excess withdrawals.

Riders included at no additional cost (subject to state availability)

The following riders are available at no additional cost in states where approved.

Nursing Care – Gives clients peace of mind that they will have access to a portion of savings without surrender charges in the case of a qualifying event.

Not available in: CA, IL, LA, MA, MT, NH, NJ, SC, SD, WA, WV, WI. See policy for qualification and limitations.

Terminal Illness Benefit – Eliminates withdrawal charges for the annuitant on one withdrawal if the policy has been in force longer than one year at the onset of the terminal illness, from which the client is physician-certified to have 12 months or fewer to live.

Not available in: CA, IL, LA, MA, MO, MT, NH, NJ, OR, PA, SC, UT, WV, WI. See policy for qualification and limitations.

Emergency Access Waiver — Allows clients to have all withdrawal charges waived for 403(b) hardship or 457(b) unforeseen emergency distributions, if approved by the Plan/TPA. For separation from service or disability, 20% of withdrawal charges (for withdrawals above 10% of the accumulation

value) are waived in years 2-4; starting in year 5, all withdrawal charges are waived.

Available for 403(b) and 457(b) plans only. Approved in all states. See policy for qualification and limitations.

Zenith Income 7

Zenith Income 10

1. Rate Booster only benefits interest crediting during periods where interest is credited to that strategy. If no indexed interest is credited for that period, Rate Booster will have no effect. The charge for Rate Booster occurs for every crediting period regardless of whether interest is credited.

For Agent Use Only – Not For Use With The Public

TC7810225(0425)3

Your clients can choose from six interest crediting options!

Declared Crediting

A basic yet effective approach, in which interest is credited daily at a declared effective annual rate that we set at the start of each one-year crediting period.

S&P 500® Index

The S&P 500® is widely regarded as the best single gauge of the U.S. equities market. This world-renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500® focuses on the large-cap segment of the market, it is also an ideal proxy for the total market. Available as a 1-year or 2-year point-to-point crediting strategy.

S&P 500® Performance Trigger

This crediting strategy is based the performance of the world’s premier equities benchmark. If the index value has gone up or has stayed the same at the end of the point-to-point period, clients are credited a fixed interest rate. For example, if the performance trigger rate is 5.00%, clients would get credited 5.00%, as long as the value of the index did not decrease.

If the market index value went down, you will be credited 0.00%. So, you will never lose a penny of your premiums paid and earned interest — any gains are locked in. You can never lose interest previously credited.

Offers strong interest potential during market upturns.

S&P 500® Monthly Sum Cap

This index also tracks the world’s premier equities benchmark, but its credit is calculated based in part on the 12 monthly changes in the index during the year. Unlike the point-to-point crediting method, we apply the Cap to each monthly change, then total the 12 months (both positive and negative) to determine the credited amount.

- Offers strong interest potential during market upturns.

- Cap is determined at the start of the account year.

US Fundamental Balanced Index

This index aims to minimize volatility through a blend of U.S. equities, U.S. treasuries, and cash. The asset classes are rebalanced daily to seek to minimize risk and the mix of U.S. equities is revised quarterly. This index was created and is owned by PIMCO. Available as a 1-year or 2-year point-to-point crediting strategy.

Global Balanced Index

This index aims to enhance risk-adjusted returns by tracking a blend of global asset classes: equities, bonds, and commodities. The index composition is rebalanced among asset classes monthly based on the SG Sentiment Indicator. This indicator is made up of six cross-asset market risk measures. The overall allocation is then reviewed daily to reduce market exposure in case of high volatility. This index was created and owned by Société Générale. Available as a 1-year or 2-year point-to-point crediting strategy.

Which product is best for your client?

That depends on your client’s specific short- and long-term accumulation and income goals. Customize each client’s strategy among four unique products with a wide selection of features. Each product is available as a 7-year or 10-year policy. Zenith Growth is also available as a 5-year policy.

ACCUMULATION

Growth Driver 7

Cat No. 106723

Growth Driver 10

Cat No. 106724

Growth Driver Highlights

Cat No. 107520

Zenith Growth 5

Cat No. 106927

Zenith Growth 7

Cat No. 106721

Zenith Growth 10

Cat No. 106722

Zenith Growth Highlights

Cat No. 107603

INCOME

Income Driver 7

Cat No. 106719

Income Driver 10

Cat No. 106720

Income Driver Highlights

Cat No. 107598

Zenith Income 7

Cat No. 106717

Zenith Income 10

Cat No. 106718

Zenith Income Highlights

Cat No. 107521

Additional consumer resources

Annuities Knowledge Base Website

natl.life/101

Emergency Access Waiver flyer

Cat No. 104356

Monthly Sum Cap flyer

Cat No. 102514

Nursing Care Waiver flyer

Cat No. 100678

Fixed Indexed Annuities flyer

Cat No. 105727

Terminal Illness Waiver flyer

Cat No. 100692

SPDA Comparison Flyer

Cat No. 106664

Rates

Log into Agent Portal to View

Training Webinar Calendar

on NL Edge

SPDA Details Training Powerpoint

Log into Agent Portal to View

SPDA Key Features Training Powerpoint

Log into Agent Portal to View

What is a Volatility Control Index?

Cat No. 106300

Complete the required product training:

- Log into your National Life Group portal

- Go to https://www.nationallife.com/agent/training/product-training/annuities

- Attest you reviewed the information

You must complete product training on these new products prior to your first solicitation.

Not available to sell in NY.

Questions?

Contact the NLG Sales Desk at 1-800-906-3310, option 1.

Having eApp Trouble?

Contact iPipeline Support at 1-800-641-6557, option 1.

Indexed annuities do not directly participate in any stock or equity investments.

“Standard & Poor’s®”, “S&P®”, “S&P 500®”, and “Standard & Poor’s 500™” are trademarks of Standard & Poor’s and have been licensed for use by National Life Insurance Company and Life Insurance Company of the Southwest. This Product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representations regarding the advisability of investing in the Product. The S&P Composite Index of 500 stocks (S&P 500®) is a group of unmanaged securities widely regarded by investors to be representative of large company stocks in general. An investment cannot be made directly into an index.

The Global Balanced SG Index (the “Index”) is the exclusive property of SG Americas Securities, LLC (SG Americas Securities, LLC, together with its affiliates, “SG”). SG has contracted with [S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC] (“S&P”) to maintain and calculate the Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, and “Global Balanced SG Index” (collectively, the “SG Marks”) are trademarks or service marks of SG. SG has licensed use of the SG Marks to Life Insurance Company of the Southwest (“LICS”) for use in a fixed indexed annuity offered by LICS (the “Fixed Indexed Annuity”). SG’s sole contractual relationship with LICS is to license the Index and the SG Marks to LICS. None of SG, S&P, or other third party licensor (collectively, the “Index Parties”) to SG is acting, or has been authorized to act, as an agent of LICS or has in any way sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Fixed Indexed Annuity or provided investment advice to LICS. No Index Party has passed on the legality or suitability of, or the accuracy or adequacy of the descriptions and disclosures relating to, the Fixed Indexed Annuity, including those disclosures with respect to the Index. The Index Parties make no representation whatsoever, whether express or implied, as to the advisability of purchasing, selling or holding any product linked to the Index, including the Fixed Indexed Annuity, or the ability of the Index to meet its stated objectives, including meeting its target volatility. The Index Parties have no obligation to, and will not, take the needs of LICS or any annuitant into consideration in determining, composing or calculating the Index. The selection of the Index as a crediting option under a Fixed Indexed Annuity does not obligate LICS or SG to invest annuity payments in the components of the Index. THE INDEX PARTIES MAKE NO REPRESENTATION OR WARRANTY WHATSOEVER, WHETHER EXPRESS OR IMPLIED, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, THOSE OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE), WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN OR RELATING THERETO, AND IN PARTICULAR DISCLAIM ANY GUARANTEE OR WARRANTY EITHER AS TO THE QUALITY, ACCURACY, TIMELINESS AND/OR COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN, THE RESULTS OBTAINED FROM THE USE OF THE INDEX AND/OR THE CALCULATION OR COMPOSITION OF THE INDEX, OR CALCULATIONS MADE WITH RESPECT TO ANY FIXED INDEXED ANNUITY AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE OR OTHERWISE. THE INDEX PARTIES SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR OR OMISSION IN THE INDEX OR IN THE CALCULATION OF THE INDEX, AND THE INDEX PARTIES ARE UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN, OR FOR ANY INTERRUPTION IN THE CALCULATION OF THE INDEX. NO INDEX PARTY SHALL HAVE ANY LIABILITY TO ANY PARTY FOR ANY ACT OR FAILURE TO ACT BY THE INDEX PARTIES IN CONNECTION WITH THE DETERMINATION, ADJUSTMENT OR MAINTENANCE OF THE INDEX. WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL AN INDEX PARTY HAVE ANY LIABILITY FOR ANY DIRECT DAMAGES, LOST PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. No Index Party is a fiduciary or agent of any purchaser, seller or holder of a Fixed Indexed Annuity. None of SG, S&P, or any third party licensor shall have any liability with respect to the Fixed Indexed Annuity in which an interest crediting option is based is on the Index, nor for any loss relating to the Fixed Indexed Annuity, whether arising directly or indirectly from the use of the Index, its methodology, any SG Mark or otherwise. Obligations to make payments under the Fixed Indexed Annuities are solely the obligation of LICS. In calculating the performance of the Index, SG deducts a maintenance fee of 0.50% per annum on the level of the Index, and fixed transaction and replication costs, each calculated and deducted on a daily basis. The transaction and replication costs cover, among other things, rebalancing and replication costs. The total amount of transaction and replication costs is not predictable and will depend on a number of factors, including the leverage of the Index, which may be as high as 200%, the performance of the indexes underlying the Index, market conditions and the changes in the market states, among other factors. The transaction and replication costs, which are increased by the Index’s leverage, and the maintenance fee will reduce the potential positive change in the Index and increase the potential negative change in the Index. While the volatility control applied by the Index may result in less fluctuation in rates of return as compared to indices without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls.

The PIMCO US Fundamental Balanced Index (the “Index”) is a trademark of Pacific Investment Management Company LLC (“PIMCO”) and has been licensed for use for certain purposes by National Life Insurance Company (the “Company”) with respect to this annuity (“the Product”). The Index is the exclusive property of PIMCO and is made and compiled without regard to the needs, including, but not limited to, the suitability, appropriateness or needs, as applicable, of the Company, the Product, or any Product owners. The Product is not sold, sponsored, endorsed or promoted by PIMCO or any other party involved in, or related to, making or compiling the Index. It is not possible to directly invest in the Index. PIMCO does not make any warranty or representation as to the accuracy, completeness, or availability of the Index or information included in the Index and shall have no responsibility or liability for the impact of any inaccuracy, incompleteness, or unavailability of the Index or such information. Neither PIMCO nor any other party involved in, or related to, making or compiling the Index makes any representation or warranty, express or implied, to the Product owner, the Company, or any member of the public regarding the advisability of purchasing annuities generally or the Product particularly, the legality of the Product under applicable federal or state securities, state insurance and any tax laws, the ability of the Product to track the performance of the Index, any other index or benchmark or general fixed income market or other asset class performance, or the results, including, but not limited to, performance results, to be obtained by the Company, the Product, Product owners, or any other person or entity. PIMCO does not provide investment advice to the Company with respect to the Product, to the Product, or to Product owners. Neither PIMCO nor any other party involved in, or related to, making or compiling the Index has any obligation to continue to provide the Index to the Company with respect to the Product. Neither PIMCO nor any other party involved in, or related to, making or compiling the Index makes any representation regarding the Index, Index information, performance, annuities generally or the Product particularly. PIMCO disclaims all warranties, express or implied, including all warranties of merchantability or fitness for a particular purpose or use. PIMCO shall have no responsibility or liability with respect to the Product. The Index is comprised of a number of constituents, some of which are owned by entities other than PIMCO. The Index relies on a variety of publically available data and information and licensable equity and fixed income sub-indices. All disclaimers referenced in herein relative to PIMCO also apply separately to those entities that are owners of the constituents of the PIMCO Index and to the Index Calculation Agent.

National Life Group® is a trade name representing various affiliates, which offer a variety of financial service products. Life Insurance Company of the Southwest, Addison, TX, is a member of National Life Group. Consumer materials linked to in this communication are approved for print use or to email to consumers who have requested it using a unique individual email only. Please note that unsolicited email marketing is subject to additional anti-spam requirements and should be submitted for advertising compliance approval prior to use.

No bank or credit union guarantee | Not a deposit | Not FDIC/NCUA insured | May lose value | Not insured by any federal or state government agency

Guarantees are dependent upon the claims-paying ability of the issuing company.

FOR AGENT USE ONLY – NOT FOR USE WITH THE PUBLIC

TC7810225(0425)3 | Cat No 106749(0425)